Adding bonuses/deductions to employees

You can add bonuses/deductions to an employee in several ways:

- via the form

- by import

- on the employee profile

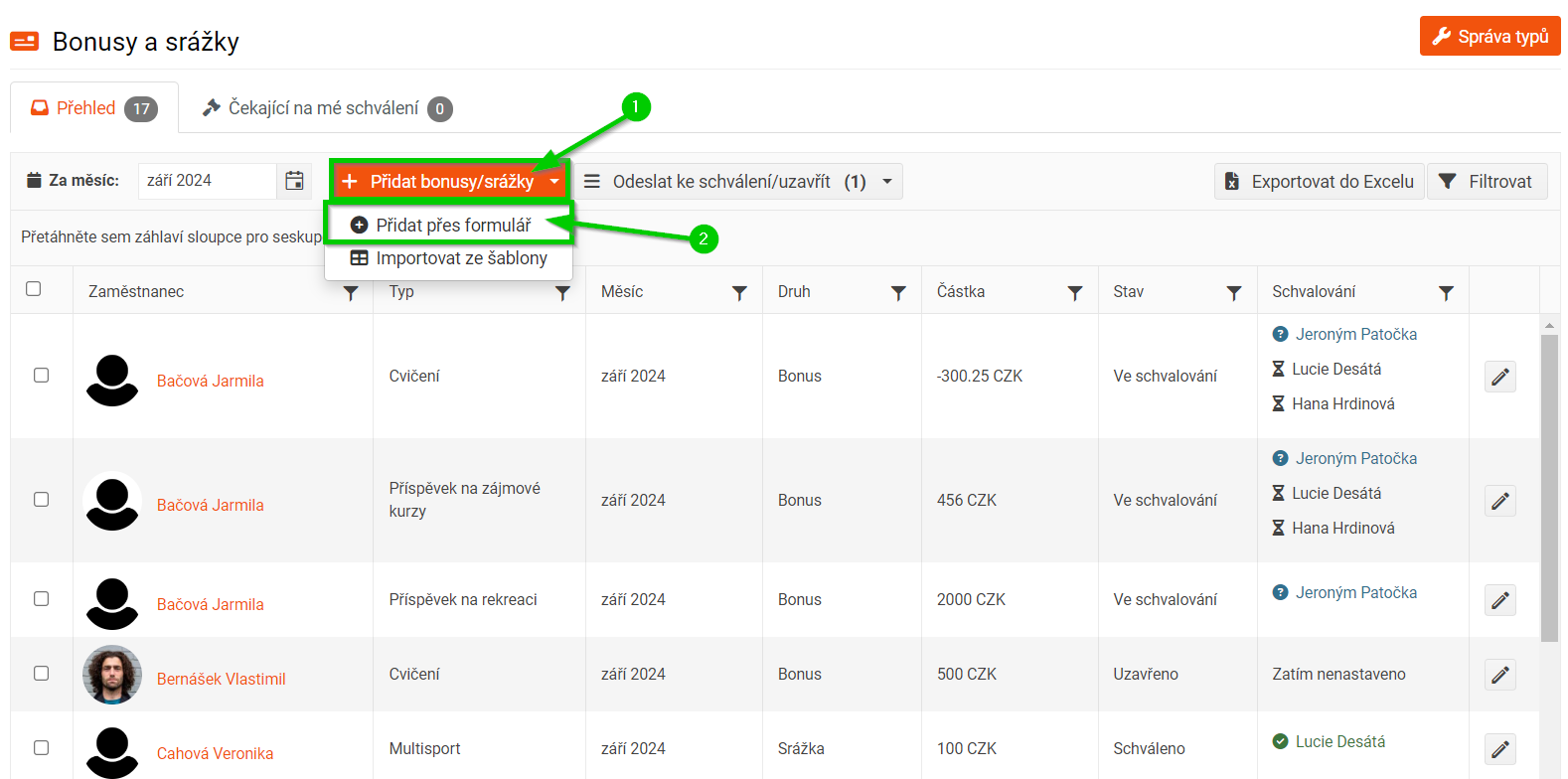

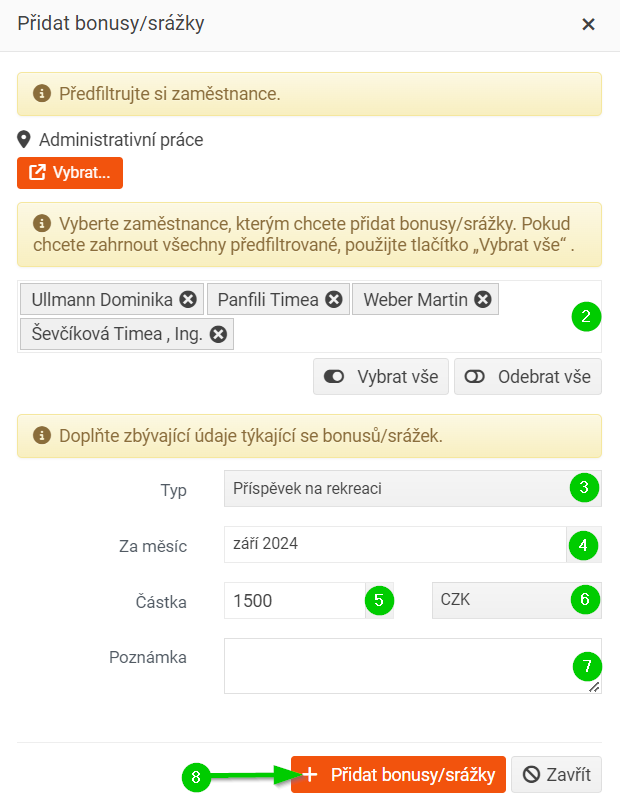

Adding bonuses/deductions via the form

- On the Bonuses and Deductions page, click Add Bonuses/Deductions > Add via Form .

Fill out the displayed form according to the following points:

- Select the employees you want to add a bonus to. You can use targeting to pre-filter employees. For example, you can filter by job title, company, group, etc. You can combine criteria.

- Select the bonus type .

- Select the month you want to add the bonus for from the calendar. The current month is pre-filled by default.

- Enter the amount (bonus/deduction value).

- Select currency .

- Add a note .

- Add a bonus to selected employees using the Add Bonuses/Deductions button.

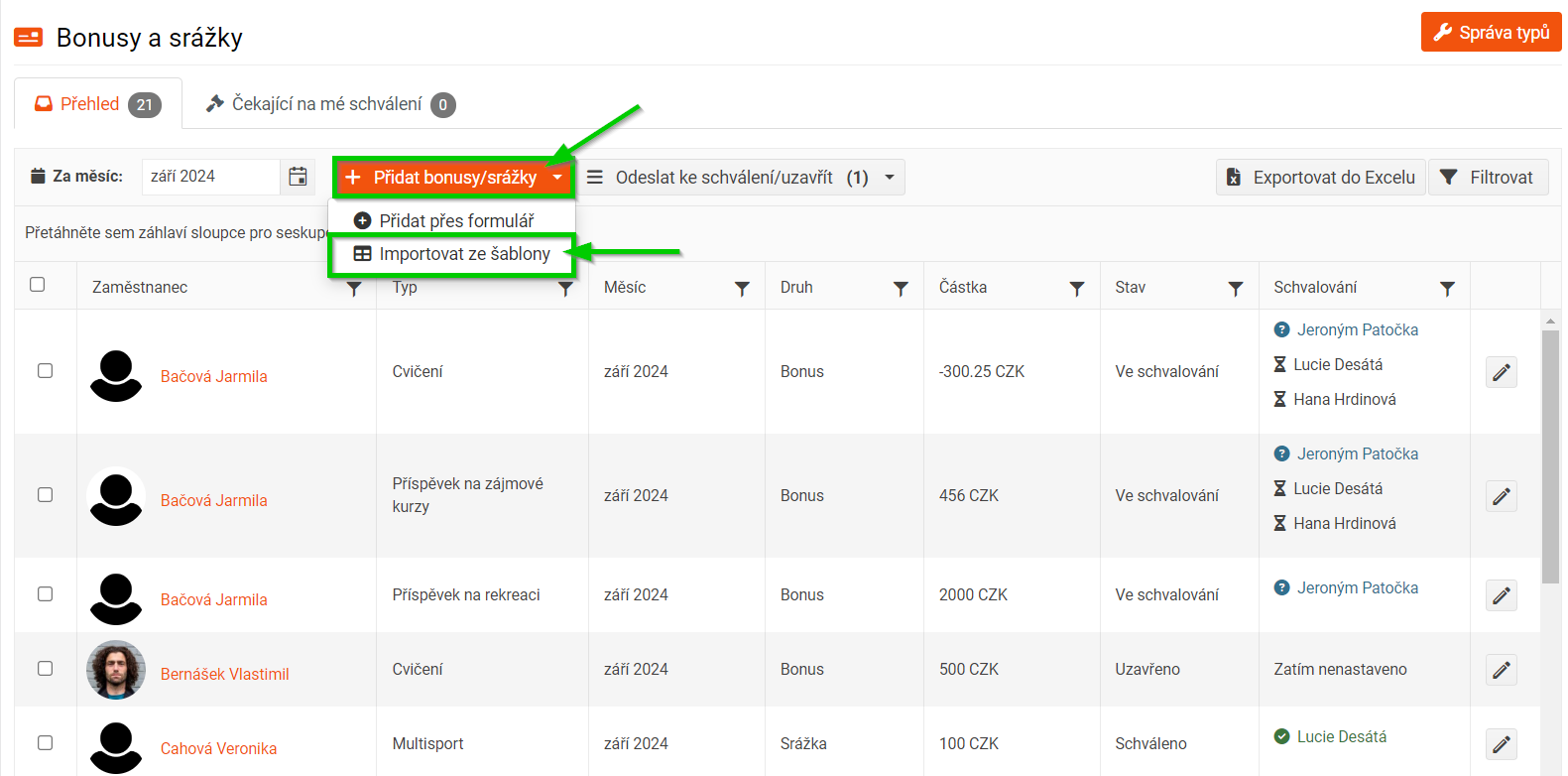

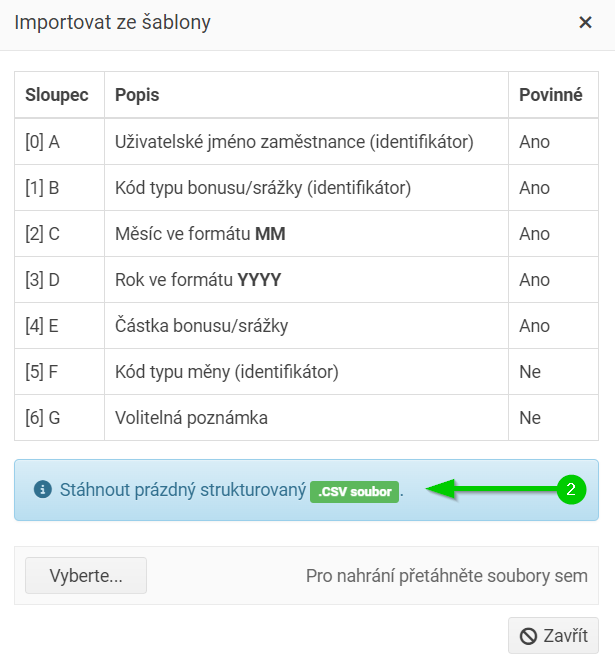

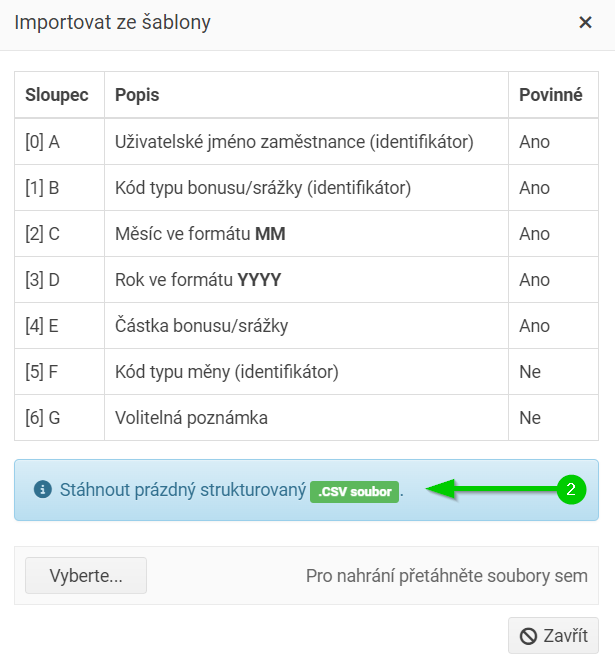

Adding bonuses/deductions by import

- On the Bonuses and Deductions page, click Add Bonuses/Deductions > Import from Template .

- Download a blank structured .CSV file .

- Fill out the downloaded file. Required fields are marked with an asterisk.

- Upload the completed file back and click Upload files .

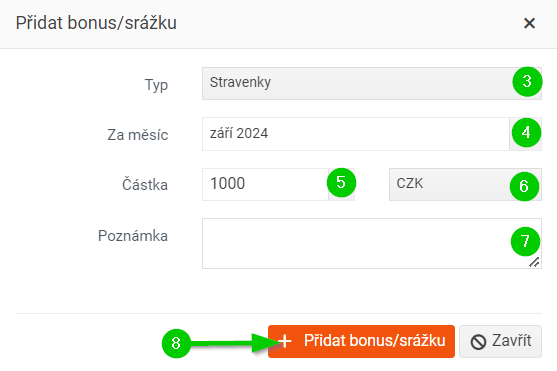

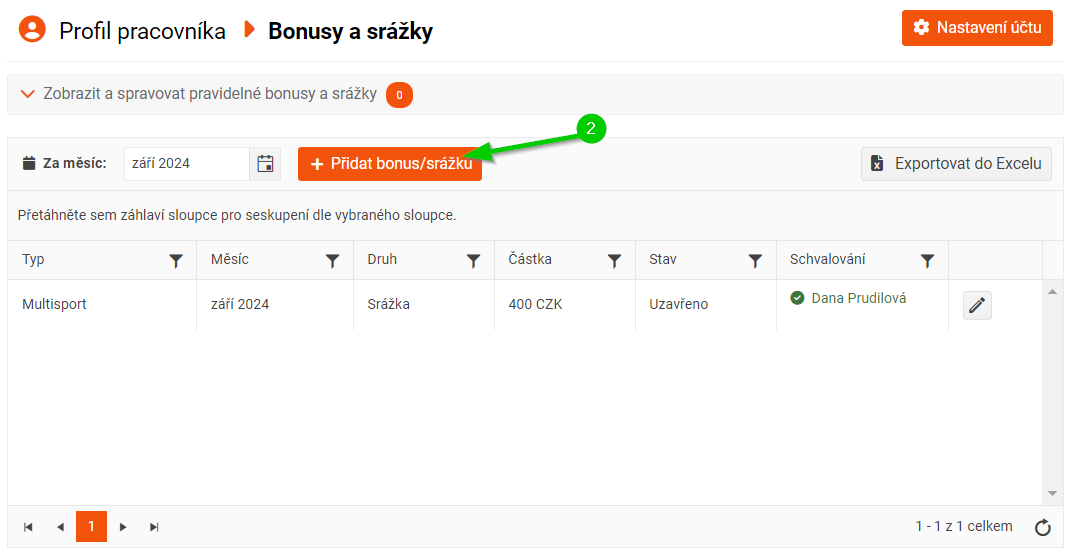

Adding bonuses to an employee profile

- Go to the Bonuses and Deductions tab in the employee profile .

- Click the Add bonus/deduction button.

Fill out the displayed form according to the following points:

- Select the type of bonus/deduction.

- From the calendar, select the month you want to add the bonus/deduction for . The current month is pre-filled by default.

- Enter the amount (bonus/deduction value).

- Select a currency . By default, the currency that the selected employee has set in their profile on the Work Data tab in the Salary section is pre-set. If the employee has no currency set, the currency that is first in the relevant code list is pre-filled.

- Add a note .

- Add a bonus using the Add bonus/deduction button.